About the two consulting firms

With the rise of alternative fuels and rapidly changing customer preferences, both firms asked themselves: is there a future for service stations?

Both McKinsey & Company and Boston Consulting Group (BCG) are renowned global management consulting firms. This article summarizes BCG’s research titled ‘A New Era for Fuel Retailers’ from 2022. Additionally, we are examining the publication ‘Fuel in the Age of New Mobility’ by McKinsey from the same year.

Similarities between the two reports

Let’s begin with an overview of the McKinsey report. Their research indicates that the fuel retail industry has reached a crucial turning point, compelling operators to swiftly reassess their strategies, devise new tactics, and undergo business transformations. While fuel retail has demonstrated resilience over the past decade, shifts in consumer behavior, technological advancements, and the ascent of electric vehicles (EVs) are reshaping the terrain.

McKinsey emphasizes: “Operators must innovate and adopt strategies such as convenience retail and EV charging to ensure sustained profitability.” The research highlights the decline in fuel demand and the upsurge in non-fuel retail, with EV charging presenting significant growth potential. Their conclusion is clear: “For success, fuel retailers must optimize their core business, establish a distinctive convenience value proposition, and formulate a comprehensive EV strategy.”

Boston Consulting Group conveys a similar message in their research titled ‘A New Era for Fuel Retailers.’ They acknowledge similar disruptions, such as the transition to electric vehicles (EVs), evolving customer habits, and geopolitical events. BCG’s conclusion is noteworthy: “To achieve success, fuel stations should diversify and modernize their pumps with sustainable fuels and EV charging stations, transforming convenience stores to align with evolving consumer preferences, and leveraging their real estate for services and logistics hubs.”

Key business strategies for service stations by BCG and McKinsey

Fuel retail is essential for oil and gas companies’ diversification into sustainable products and services. Let’s look at the specifics. What strategies do these two consulting firms come up with to build the future of fuel stations?

Offer a wide range of fuel and charging

First, let’s start with the obvious strategy. Retailers are innovating their fuel offerings with sustainable options like biofuels, hydrogen fuels, EV charging and liquefied petroleum gas. This includes enhanced convenience through technologies like RFID and license-plate readers.

Becoming a services and logistics hub

An innovative approach that fuel retailers might consider involves the transformation of their sites into service and logistics hubs. Essentially, this entails optimizing their real estate by capitalizing on it for other businesses, particularly those that prioritize cost-effective space and proximity to transportation or customer hubs.

This could entail leasing it to other brands or initiating new ventures themselves. Possibilities encompass services such as parcel and pickup services, postal and ATM services. More inventive options include the establishment of dark stores and kitchens, along with last-mile logistics hubs for tasks like sorting, delivery, and transfer points. Additionally, lockers for customer pickup could be integrated.

Go beyond the current fuel convenience store formula

Fuel retail must adapt due to changing trends and consumer demographics as it comes to convenience stores. Sustainability influences buying choices for Generations X, Y, and Z, and online ordering is growing year on year.

The two reports offer four options to explore: develop new franchises, improve their own convenience brand, offer better curated products, and delivery. McKinsey advises looking beyond fuel retail. Ideas include quick-service restaurants, hospitality, and innovative drive-through services.

Develop new offerings around the vehicle

Both reports mention multiple business models directly linked to car ownership. Let’s look at the three strategies within this category.

The first option focuses on buying and selling secondhand cars. Vitol, an oil and gas leader in Turkey and Pakistan, funded a startup called Vavacars. The company addresses the challenges of buying and selling used cars. Recognizing the lack of transparency and time-consuming nature of the process, Vavacars was introduced as an online used-car marketplace. It offers instant free valuation, qualified engineer inspections, and a quote with secure payment within 45 minutes. The investment looks promising for Vitol. The startup is successful, trading 4,500 cars and generating $110 million gross merchandise value in its first year, making it the fastest-growing startup in Turkish history.

The second option is offering car insurance and vehicle financing. Obtaining car insurance has typically been a time-consuming effort that involves combing through comparison websites and talking to brokers until the right deal appears. Emirates National Oil Company (ENOC) introduced Beema, the UAE’s first pay-per-kilometer car insurance. The highly successful service was voted Best Insurtech in the Middle East.

A third option is offering car maintenance and car wash services. A recent development is mobile vehicle maintenance, which eliminates long wait times at the mechanic and the need to arrange alternate transportation. Need examples? BP’s Zippity, launched in the US, offers a pricing guide up front and gets customer approval before undertaking repairs. Self-service car wash is here to stay and is another option to diversify offerings.

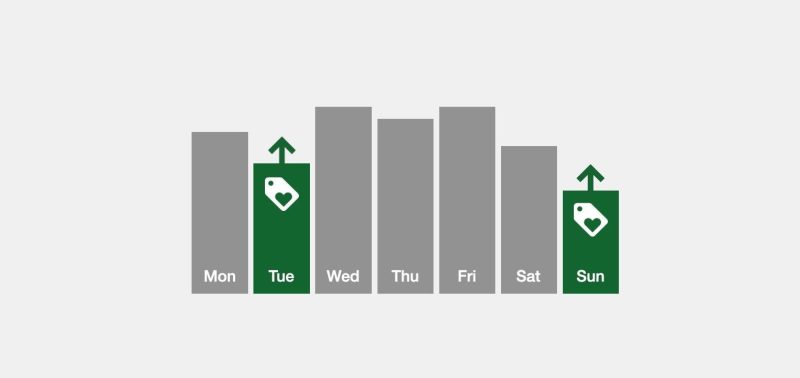

Invest in innovative loyalty programs and seamless self-service experiences

Whatever business strategy is implemented, both BCG and McKinsey agree that a key driver for success is becoming the preferred destination for customers. As McKinsey states: “Fuel retailers must invest in their data practices to enhance customer experience, provide seamless self-service experiences, and create innovative loyalty programs.”

Improve your loyalty programs with SmartNow

Looking for innovative ways to boost revenue and retention? We help companies like BP and TotalEnergies in their transition by creating innovative loyalty programs. By adding connectivity to your service machines, we’re able to build loyalty programs and improve cross-selling and upselling.

During a 45-minute exploratory call, we’ll delve into digitization use cases related to loyalty, cross-selling, and more. Feel free to schedule a call with us to learn more about the potential of smart self-service machines.